Annual Compliance with IRAS and ACRA

Annual Compliance with IRAS and ACRA

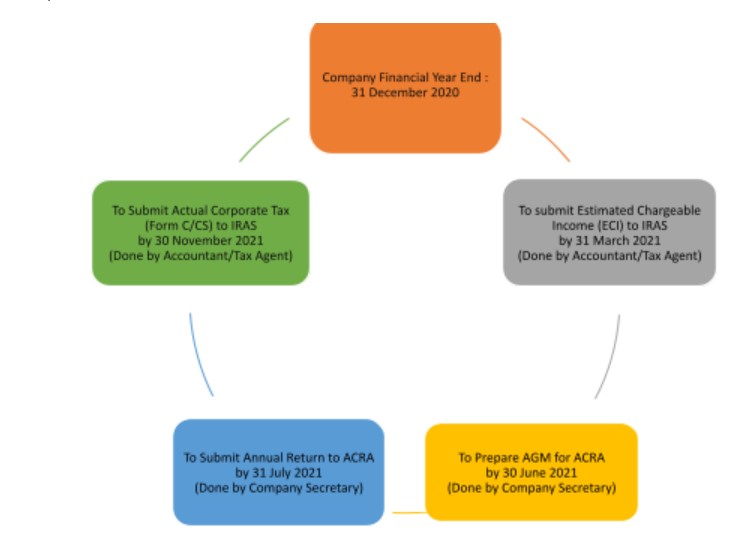

Every year, private limited companies are required to file Annual Return to ACRA (Accounting and Corporate Regulatory Authority) and Corporate Tax filing to IRAS (Inland Revenue Authority of Singapore). Below is the diagram showing the submission with due date that every company has to comply, to avoid any penalty charges. Let’s take a look at the process of a company’s annual compliance with the regulator (let us use 31 December 2020 as an example of a company’s financial year end).

At YTA, you know your business is in good hand as far as annual compliance with ACRA and IRAS is concerned. Our professional support will help your business to submit the required file on time, so you can focus on your business.

Contact Us

Your Trusted Adviser Pte. Ltd.

1 Paya Lebar Link, #04-01 Paya Lebar Quarter 1, Singapore 408533

(65) 6513 0842

(65) 6513 0842

info@ytadviser.com

![]()

Contact Us

Home

Service

Products

Promotions

Contact