Individual Risk Management

Risk is more than a popular board game, it is the exposure to danger or loss. It can manifest in organisations as market, credit or operational risks. Individuals are also not exempt from risks such as diseases, occupational hazards or income loss.

Let us begin with risk identification. Risks are generally categorised by their possibility of occurrence and their severity. Being struck by lightning is less likely than hurting your back during work, but the consequences are more severe.

Different risks are lurking in the corner too, as you enter various stages of life. An individual in the thirties may worry about pregnancy complications the mother may develop, while someone in their fifties may have concerns about sudden retrenchment or medical emergencies.

So now the question is, how can we manage the risks?

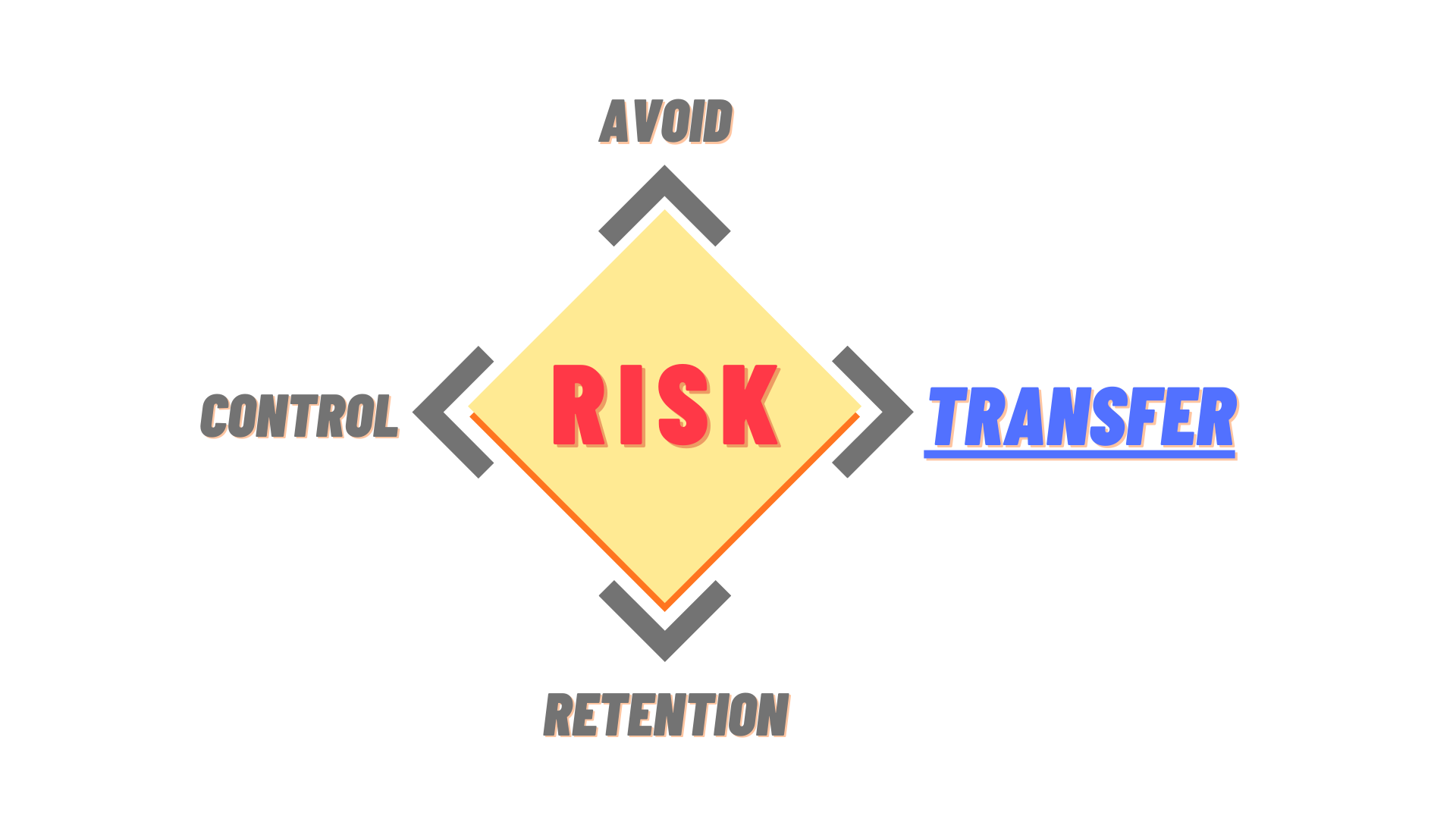

After you have ascertained the risks, you can manage them with 4 general approaches: Avoid, Control, Retention, and Transfer. Some dangers, such as armed hostilities in foreign countries, can be avoided by doing prior research and changing travel plans.

Control your risk by limiting exposure to undesirable factors or activity, e.g. cutting your sugar intake to lower the chances of contracting diabetes, lowering your investments in oil when prices are volatile.

Risk retention is another strategy, whereby you undertake the risk instead of managing it. This is a feasible solution when the cost of minimising the risk far outweighs its consequences.

Alternatively, transfer the risk to other parties or entities that can provide protection or compensation when the risk becomes a reality. Insurance is a prime example of risk transfer.

Quality insurance can help preserve your hard-earned savings and offset a considerable percentage of medical expenses if you require hospitalisation and medical treatment. It can also provide replacement income in the event that an accident robbed you of the ability to continue working. This is particularly vital, as the risk of disease inevitably increases with age.

Therefore, we have a suite of products that is able to cater specifically to each of your needs.

Personal Accident

Healthcare

Travel

Household

Motor

Maid

Maternity

Contact Us

Your Trusted Adviser Pte. Ltd.

1 Paya Lebar Link, #04-01 Paya Lebar Quarter 1, Singapore 408533

(65) 6513 0842

(65) 6513 0842

info@ytadviser.com

![]()

Contact Us

Home

Service

Products

Promotions

Contact